South Korea is moving toward allowing the initial coin offering (ICO) to help startups raise funds for developing blockchain technology. However, the permit will be conditional, according to sources.

A government official said it is against the global trend to ban ICO completely, and he added that policymakers are forming a consensus to permit the ICO conditionally. He was not specific on what requirements potential issuers must meet. Details would come out when the government announces the plan this year.

He and other government officials said that the ICO issuance might be allowed only when the issuers meet the specific requirements. They indicated that the government might designate institutional investors eligible for handling the ICO business. ” ICO may be possible within the special business zones,” they said, “The ICO issuers, namely startups with viable technology, might be eligible and the issuers must abide by the requirements that the money is used only for developing and commercializing technologies.”

The Prime Minister’s Office had said last month the government would issue its position on the ICO in November. A Prime Minister’s Office official said Monday that the ICO plan would come out after ironing out differences among the government ministries. The Financial Supervisory Commission is most skeptical of the ICO issue.

The ICO issue is a dilemma for policymakers. The ICO enables startups to mobilize funds to finance their blockchain and cryptocurrency business. However, bogus companies have abused the ICO to swindle money from investors although they have no critical technology. Many South Koreans were blindly putting their money into the ICO fund, out of the false belief that they can generate attractive returns through investment. South Korean regulators are also concerned over the abuse of the ICO to launder money by tax evaders and criminal rings, including narcotics dealers.

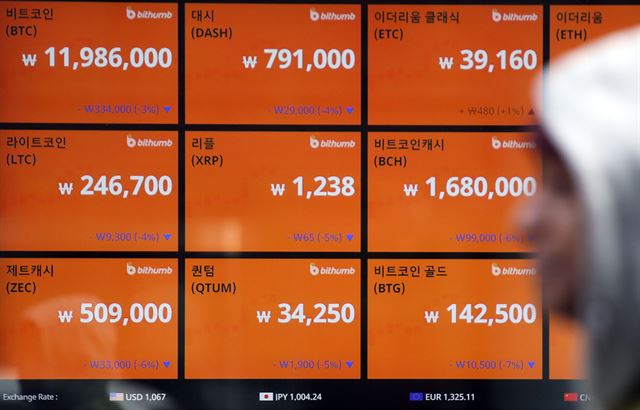

Out of these concerns, the government completely banned the ICO in September last year. Korea and China are the countries that prohibit the ICOs.

However, many South Korean blockchain startups moved to such blockchain-friendly countries as Switzerland, Singapore, and Hong Kong to raise money.

The global ICO market has grown by leaps and bounds. The global ICO market would reach a record high of $9 billion this year, up from $9 million in 2015 and $5.5 billion last year.